Is There a Difference in Liabilities and Expenses Explain

Capital stack ranks the priority of different sources of financing. If weve already made choices where our expenses are higher than they should be then there is hope if you pursue a change in behavior.

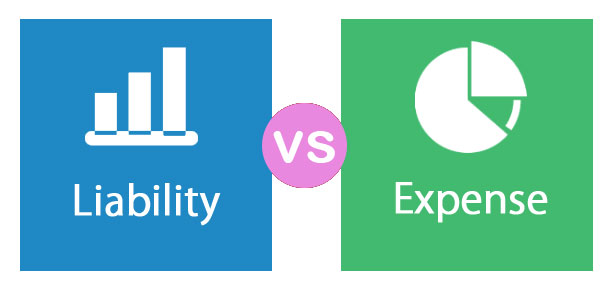

Liability Vs Expense 9 Best Differences To Learn With Infographics

Everyone has to have food to eat and a place to live.

. Liabilities in a business arises due to owing funds to parties outside the company. In addition to what youve already learned about assets and liabilities and their potential categories there are a couple of other points to understand about assets. Every business must record payroll liabilities and payroll expenses using the accrual method of accounting which matches revenue earned with expenses incurred.

Some of the costs include salaries utilities transportation costs and depreciation expenses. The matching concept presents a more accurate. Liabilities arise from the debt taken and the nature of debt is dependent on the requirement for taking it.

The money in the companys checking account. Assets comprise of such items that can be comprehended as the components of the property which a company or an individual owns. Assets liabilities equity.

Both of them relate to the primary money-earning operations of a business. You can think of assets as something that enables a business to create wealth in the future. The accrual method records payroll expenses in the month they are incurred regardless of when the expenses are paid in cash.

Expenses are recorded in the income statements since higher the expenses lower. An additional difference is that an expense appears in the income statement while the effect of an expenditure appears in the balance sheet either as a reduction of cash or an increase in liabilities. The similarity between them is that both the expense and cost represent the use of resources owned by a business in relation to some revenue.

Cash helps a business to pay for expenses that are necessary to earn an income. An indicator of a successful business is one that has a high proportion of assets to liabilities since this indicates a higher degree of liquidity. Expense vs Cost Expense and cost are closely related terms but there are few points of distinction between the two.

Thus they may be short term or long term. Next liabilities are subtracted the same as expenses and taxes is subtracted in an income or profit equation and youre left with the net result your total assets. Expenses are incurred and payments are made during the current period.

Indicating you have paid the accrued wage. The cost is the one-time price you pay. Liabilities are accrued over time and then paid off Expenses are generally paid off in real-time.

When a liability is booked the company records a liability as a credit and debits an expense account. Difference between liability and expense. Managing short-term debt and having adequate working.

Accounts payable on the other hand are current liabilities that will. Salaries and wages you debit the payable and credit the expense. Paying interest every month on your mortgage for that building is an expense.

Expenses reduce net income liabilities do not. There is usually no asset something of value associated with an expense. The main difference between liabilities and expenses are the timing under which they are realised.

Whereas liabilities are benefits that are obtained now for which obligations need to be met at a future date. What is an expense. Liabilities are obligations to pay expenses are payments.

When you pay an expense eg. To define an expense is simply a cost or charge. 9 Define Explain and Provide Examples of Current and Noncurrent Assets Current and Noncurrent Liabilities Equity Revenues and Expenses.

Buying a building is a cost. A further difference is that expenses are generally associated with the short-term operations of a business while some expenditures are associated with the. Accrued expenses are those liabilities that have built up over time and are due to be paid.

Liabilities are legal obligations or debt Senior and Subordinated Debt In order to understand senior and subordinated debt we must first review the capital stack. What are the Main Types of Liabilities. Expenses refer to the costs incurred by enterprises so that they can gain revenue.

This is a legal obligation the company is bound to fulfil in the future. Assets result in the inflow of valuable resources to its owners or users whereas liabilities cause an outflow of valuable resources from the borrower. Current non-current and contingent liabilities.

Expenses are current-period expenditures that do not have future benefit. Liabilities exist when a company has a future obligation related to a benefit already received. Difference Between Assets and Liabilities In accounting and business terms students might have come across these terms assets and liabilities.

A companys working capital is the difference between its current assets and current liabilities. We can often control the expenses that we owe. Current liabilities are usually paid with current assets.

Expenditures are costs incurred when purchasing assets for the company or paying for a significant proportion of company liabilities. The key difference between current and long term liabilities is that. The principal difference between liability and expense is timing.

There are three primary types of liabilities. A liability is an obligation or debt reported on the balance sheet of the company. The first part equity is what you currently have before liabilities are taken away.

Examples of current liabilities may include accounts payable and customer deposits. Although we use the term cost with expenses they are really just payments. It may occur because the company bought a product or service that it has not yet paid or because it borrowed money that it will repay later.

An expense is the using up of assets or services. The main difference between assets and liabilities is that assets provide a future economic benefit while liabilities present a future obligation.

Differences Between Assets And Liabilities Liability Asset Intangible Asset

Liability Vs Expense 9 Best Differences To Learn With Infographics

/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

No comments for "Is There a Difference in Liabilities and Expenses Explain"

Post a Comment